Accounting Dictionary - Letter E

- Earnings: The profit earned by a company, often used in financial reporting and analysis.

- Earnings Before Interest and Taxes (EBIT): A measure of a company's earnings before interest and taxes, often used in financial reporting and analysis.

- Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA): A measure of a company's earnings before interest, taxes, depreciation, and amortization, often used in financial reporting and analysis.

- Earnings Per Share (EPS): A measure of a company's earnings per share of stock, often used in financial reporting and investment analysis.

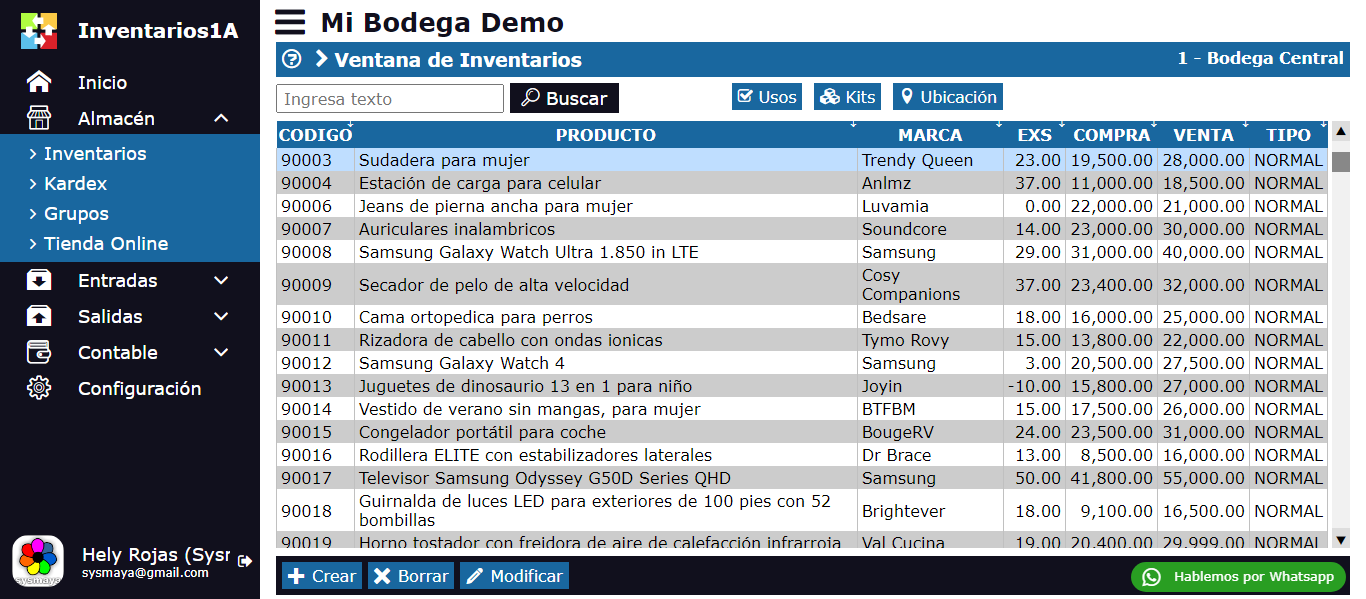

- Economic Order Quantity (EOQ): The optimal quantity of inventory to order at one time, often used in inventory management and supply chain management.

- Economic Value Added (EVA): A measure of a company's economic value added, often used in financial reporting and analysis.

- Effective Interest Rate: The interest rate that is actually paid on a loan or investment, often used in financial reporting and analysis.

- Employee Benefits: Benefits provided to employees, such as health insurance, retirement plans, and paid time off, often used in human resources management and financial reporting.

- Encumbrance: A restriction or limitation on the use of funds or assets, often used in financial reporting and budgeting.

- Ending Inventory: The amount of inventory on hand at the end of an accounting period, often used in financial reporting and inventory management.

- Entity: A separate and distinct organization, such as a corporation or partnership, that operates for profit.

- Entry: A record of a financial transaction in a company's accounting records, often used in financial reporting and accounting.

- Equity: The ownership interest in a company, often used in financial reporting and analysis.

- Equity Method: A method of accounting for investments in other companies, often used in financial reporting and analysis.

- Equity Multiplier: A measure of a company's equity multiplier, often used in financial reporting and analysis.

- Equivalent Units: A measure of the number of units produced or sold, often used in financial reporting and analysis.

- Error: A mistake or inaccuracy in financial reporting or accounting, often used in financial reporting and auditing.

- Escrow: A fund or account that holds money or assets until certain conditions are met, often used in financial reporting and risk management.

- Estimated Liability: A liability that is estimated or anticipated, often used in financial reporting and risk management.

- Ethics: The principles and values that guide a company's behavior and decision-making, often used in financial reporting and corporate governance.

- Expenditure: An amount spent or disbursed by a company, often used in financial reporting and budgeting.

- Expense: A cost or expenditure incurred by a company, often used in financial reporting and accounting.

- Expired Costs: Costs that have been incurred but are no longer relevant or useful, often used in financial reporting and accounting.

- External Audit: An audit conducted by an independent third party, often used in financial reporting and auditing.