Implementing card payment in small businesses

Implementing credit card payments in a small business is an excellent way to attract more customers and increase sales. Nowadays, many consumers prefer to pay with cards due to convenience, security, and additional benefits such as reward points or cashback. Below, I explain the key steps to integrate this payment method into your business.

1. Evaluate the need and impact

Before implementing credit card payments, it is important to evaluate if it is suitable for your business. Consider factors such as the type of products or services you offer, the average ticket of your sales, and the preferences of your customers. If most of your customers already use credit cards, the investment in a payment system can be highly beneficial.

2. Select a payment service provider

To accept credit card payments, you need a payment service provider, also known as a payment processor. This is the intermediary that processes transactions between your business and the issuing banks of the cards. Some of the most well-known providers are PayPal, Square, Stripe, and Mercado Pago. When selecting a provider, consider:

- Commissions and fees: Payment processors charge a fee for each transaction, usually a percentage of the total plus a fixed fee. Compare the fees of different providers to find the option that best suits your business.

- Integration with your point of sale (POS) system: Make sure the processor integrates easily with your POS or e-commerce system if you sell online.

- Support and customer service: Good technical support is crucial to resolve issues quickly and minimize interruptions in your operations.

3. Obtain the necessary equipment

To accept credit card payments in a physical store, you will need a point of sale terminal or a card reader. These devices can be fixed or mobile, depending on the needs of your business. Some modern terminals also allow contactless payments (contactless) through technologies such as NFC, which is an additional advantage in times where hygiene and speed are priorities.

If your business is online, you will need a payment gateway that integrates with your website. The payment gateway is a service that authorizes credit card payments for online businesses, allowing your customers to make secure payments through your website.

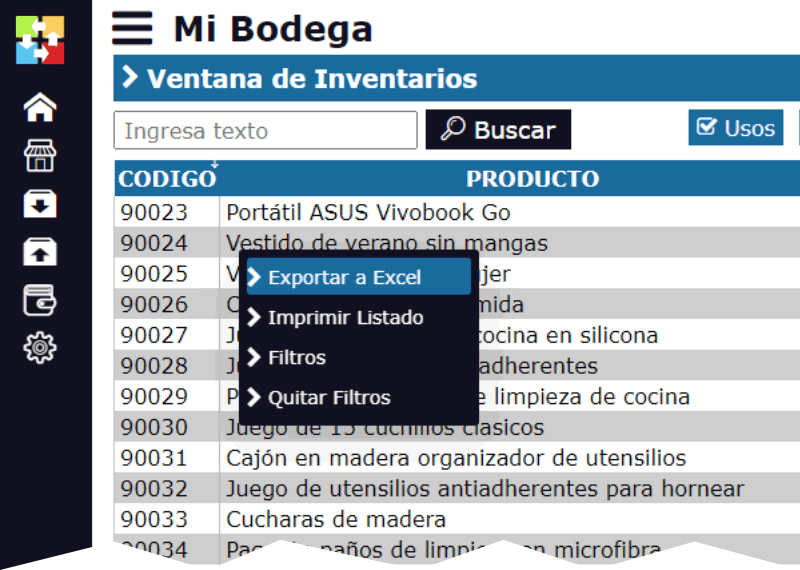

4. Set up your payment system

Once you have selected a payment service provider and obtained the necessary equipment, it is time to set up the system. This process may vary depending on the provider, but generally includes:

- Registration and account setup: You will need to register your business with the provider and provide financial information, such as your bank account, to receive the funds from transactions.

- Terminal setup: If you use a physical terminal, you will need to set it up to work with your payment processor account. This may include installing software and performing test transactions.

- Online integration: If you sell online, you will need to integrate the payment gateway with your website. This may require the assistance of a web developer if you are not familiar with coding.

5. Train your staff

It is essential that your team is trained to use the new credit card payment system. Make sure they know how to process a sale, handle returns, and resolve common issues that may arise during a transaction. Additionally, it is important that they understand security policies to protect both customer and company information.

6. Comply with security regulations

Security is a priority when accepting credit card payments. Make sure your business complies with the PCI DSS (Payment Card Industry Data Security Standard) standards, which establish security requirements to protect credit card data. This includes measures such as:

- Data encryption: Ensure that card information is encrypted during transmission and storage.

- Regular software updates: Keep all payment system software up to date to protect against vulnerabilities.

- Security training: Train your staff on how to handle card information securely and how to recognize potential fraud.

7. Communicate to your customers

Once you are ready to accept credit card payments, inform your customers. Place visible signs in your business that indicate you accept cards and update your website and social media so that online customers are also aware. Make sure your customers know what types of cards you accept (Visa, Mastercard, American Express, etc.).

8. Monitor and adjust as necessary

After implementing credit card payments, it is important to monitor their impact on your business. Regularly review transaction rates, analyze sales, and adjust your strategy if necessary. If you notice a significant increase in sales, it may be a sign that accepting credit cards has been a positive step for your business.

Implementing credit card payments in a small business may seem like a challenge, but with the right preparation and focus, it is an investment that is worth it. Not only will you improve the customer experience, but you will also open the door to new sales opportunities. By following these steps, you can accept credit card payments securely and efficiently, positioning your business for success in an increasingly digital market.