How Accounting Methods Affect the Value of Your Inventory

The value of inventory is a key figure in a company's financial statements, as it directly affects the cost of sales, gross profit, and ultimately, net profitability. However, the value of inventory can vary significantly depending on the accounting method used for its valuation. In this article, we will explore how accounting methods affect the value of inventory and its implications for finance and business decision-making.

Inventory Valuation Methods

There are several accounting methods for valuing inventory, each with its own implications for the recorded value of inventory and its impact on financial statements. The most common methods include:

FIFO (First-In, First-Out)

- Description: In the FIFO method, it is assumed that the first items purchased are the first to be sold. This means that the cost of goods sold (COGS) is based on the cost of the first units acquired.

- Impact on Inventory Value: During periods of inflation, the FIFO method tends to underestimate the value of ending inventory, as the cost of older units, which is generally lower, is used to calculate COGS. As a result, the value of inventory may be higher and gross profit lower compared to other methods.

LIFO (Last-In, First-Out)

- Description: The LIFO method assumes that the last items purchased are the first to be sold. Therefore, COGS is based on the cost of the most recent units.

- Impact on Inventory Value: In an inflationary environment, the LIFO method tends to overestimate the value of ending inventory, as the cost of the most recent units, which are higher, is used to calculate COGS. This can result in a lower recorded value for inventory and a higher gross profit.

Weighted Average Cost (WAC)

- Description: The WAC method calculates the cost of inventory and COGS based on the average cost of all units available for sale during the period. The average cost is continuously adjusted as new units are acquired.

- Impact on Inventory Value: This method provides a more balanced valuation of inventory, as it distributes the cost evenly among all units. This can lead to an intermediate inventory value compared to FIFO and LIFO, and tends to smooth out cost fluctuations.

Implications for Financial Statements

The choice of inventory valuation method has several important implications for a company's financial statements:

Cost of Sales and Gross Profit

- FIFO: In times of inflation, COGS will be lower and gross profit will be higher, as the cost of older, cheaper items is used to calculate COGS. This can result in a higher tax burden.

- LIFO: In times of inflation, COGS will be higher and gross profit will be lower, as the cost of more recent, more expensive items is used to calculate COGS. This can reduce the tax burden but show lower profits.

- WAC: COGS and gross profit are adjusted more uniformly, providing a more stable view of profitability over time.

Ending Inventory Value

- FIFO: The value of ending inventory may be higher during periods of inflation, as it is based on the cost of more recent, more expensive units.

- LIFO: The value of ending inventory may be lower during periods of inflation, as it is based on the cost of older, cheaper units.

- WAC: The value of ending inventory reflects a weighted average of costs, which can be useful for companies seeking a more stable valuation.

Tax Impact

- FIFO: May lead to a higher tax burden in times of inflation due to higher gross profit.

- LIFO: May reduce the tax burden by showing lower gross profit in times of inflation.

- WAC: Generally provides an intermediate tax impact, as it smooths out fluctuations in inventory cost.

Strategic Considerations

The choice of inventory valuation method should be based on a company's specific needs and financial objectives. Some considerations include:

- Product Life Cycle: Companies with short-life or high-turnover products may benefit from the FIFO method, while those with longer-life products may prefer the LIFO method.

- Economic Conditions: In an inflationary environment, the LIFO method may be more beneficial from a tax perspective, while in a deflationary environment, the FIFO method may offer a better valuation.

- Regulations and Standards: Local accounting and tax regulations may influence the choice of method, so it is essential to be aware of current regulations.

Accounting methods used to value inventory have a significant impact on the recorded value of inventory, cost of sales, gross profit, and tax burden. Understanding how these methods affect your financial statements will enable you to make informed decisions about which method to use and how to manage your inventory effectively.

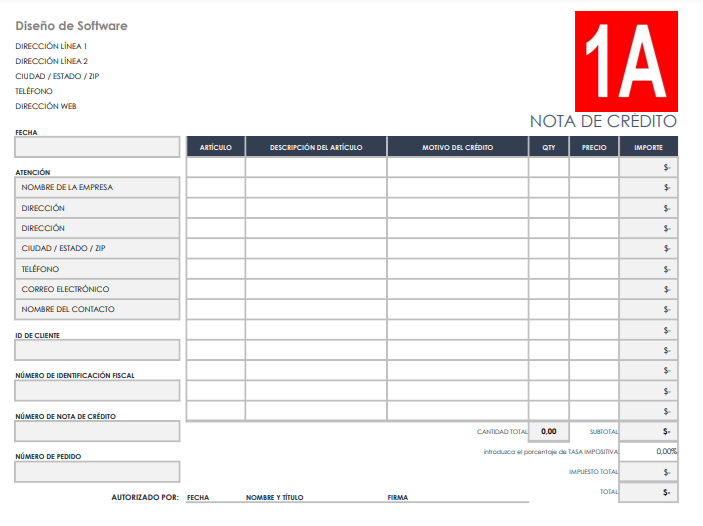

In Inventarios1A, we offer tools and solutions that facilitate the application of different inventory valuation methods, helping you manage your finances efficiently and optimize your business decisions. With a clear understanding of how accounting methods affect your inventory, you will be better prepared to face financial challenges and seize opportunities that arise in the business world.