Using Apple Pay as payment system

As a small business owner, it's crucial that your payment systems are fast, simple, and secure. One technology that meets these three criteria is Apple Pay. Not only does it offer these benefits, but it's likely that your customers will start requesting it soon. So, what's the next step? Making sure you're prepared to accept Apple Pay when your customers decide to use it.

According to a study on payment methods, we found that people who use mobile payments, like Apple Pay, highly value this option. In fact, many consider it their preferred payment method over credit cards and state that they're likely to choose businesses that accept mobile payments.

Mobile payment adoption is highest among younger groups, like millennials, who currently make up the largest generation and have significant purchasing power. That's why it's important to familiarize yourself with mobile payments as soon as possible.

Apple Pay for Businesses

Before deciding to accept Apple Pay, it's helpful to understand how it works. Apple Pay is a contactless payment method that uses near-field communication (NFC) technology. NFC allows two devices, like a smartphone and a payment reader, to communicate when they're close together.

Apple Pay is compatible with iPhone, iPad, and Apple Watch. You can learn more about how to set it up on your device.

Why Should You Accept Apple Pay and Other Mobile Payments?

There are two main reasons to accept mobile payments like Apple Pay in your business: speed and security.

Mobile payments are faster than payments with magnetic stripe or chip cards, which can significantly reduce wait times at the register and improve customer satisfaction. During high-demand times, like lunch hour, a fast-moving line means you can serve more customers, which can in turn increase your revenue.

In addition to speed, Apple Pay transactions are extremely secure. Card data is tokenized, encrypted, and constantly changing, making it difficult for fraudsters to access it. Apple Pay also requires fingerprint verification or phone passcode authentication, adding an extra layer of security. This means that even if someone manages to unlock your phone, they won't be able to access your Apple Pay account. Accepting Apple Pay in your business is a way to better protect yourself against fraud.

Costs and Functionality of Apple Pay

Apple Pay is free for customers, but it has some costs for businesses. For example, Square charges a processing fee of 2.6% plus 10 cents for contactless payments, in addition to any costs associated with the necessary hardware.

Apple Pay works as a mobile wallet from Apple. In stores, it allows customers to pay simply by holding their device near the payment reader. In apps and on websites, payments can be made with a single tap. Apple Pay uses NFC technology to make secure and fast transactions through a process of tokenization.

Apple Pay Security

It's natural to have doubts about the security of loading banking information onto a device, but Apple Pay is very secure. To authenticate a payment, Touch ID or Face ID is used, ensuring that only the device owner can authorize the transaction. Additionally, card data is encrypted and constantly changing, making it more secure than magnetic stripe cards or cash.

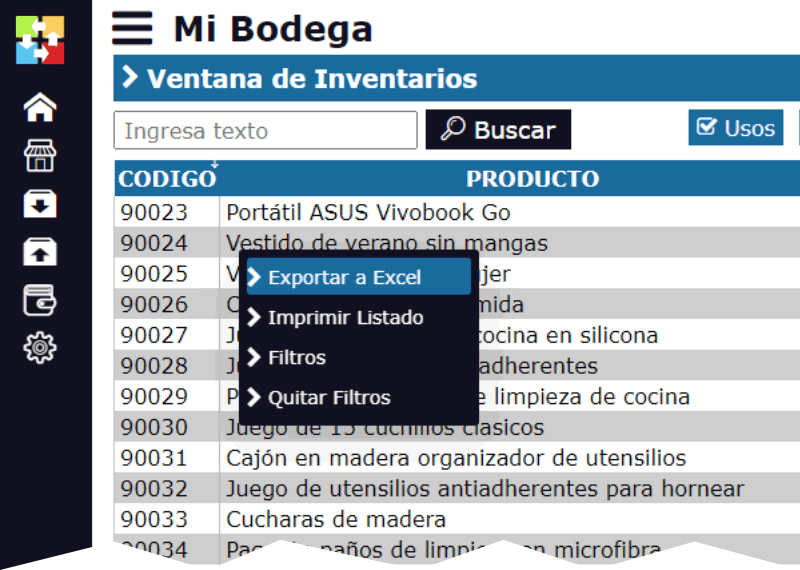

Hardware Needed for Apple Pay

To accept Apple Pay in your business, you need a terminal with NFC enabled. Square Reader, Square Stand, Square Terminal, and Square Register are options that accept contactless payments. These devices allow customers to complete transactions with just a tap of their Apple device.

Apple Pay can also be used in apps and on websites. In these cases, no NFC reader is required, but payments are authorized with Touch ID or Face ID.

Set Up Apple Pay in Your Business

Implementing Apple Pay in your business is simple. First, get a payment terminal with NFC enabled. Then, set up the reader to be accessible to customers. When a customer wants to pay, they simply need to hold their Apple device near the reader until the transaction is complete.

You can also accept Apple Pay on your website using Square's e-commerce API, which makes it easy to integrate this payment option.

Training Your Staff

It's essential that your employees are familiar with Apple Pay payments so they can recommend it to customers. Use the training materials that come with your Apple Pay marketing kit to train your staff. These materials include instructions on how to accept payments with Apple Pay and how to help customers set it up on their devices.

Informing Your Customers

Once you're ready to accept Apple Pay, let your customers know. Place Apple Pay stickers in your store so they know you accept this payment method. You can also promote this update on your social media and through emails to your regular customers.

Accepting Apple Pay not only offers your customers an additional payment option, but it also allows them to pay securely and digitally with the cards they already have in their physical wallet.