What is a Bill of Sale?

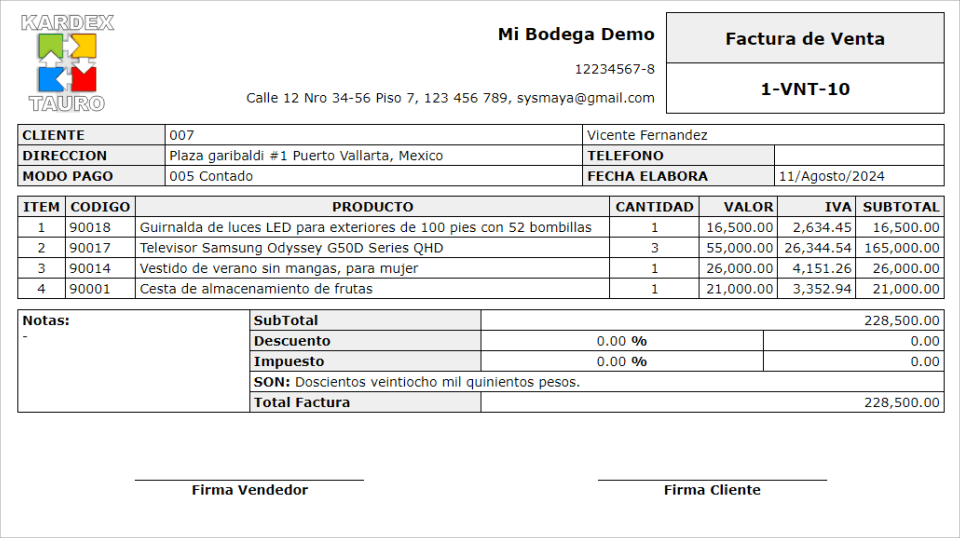

A sales invoice is a fundamental commercial document in any purchase and sale transaction of products or services. Its main function is to register and formalize the sale between a seller and a buyer, detailing the goods or services acquired, the agreed prices and payment conditions. For companies, this document is key both for accounting control and for compliance with tax regulations.

Key Elements of a Sales Invoice

Seller and Buyer Information: It must include the legal and contact information of both parties, such as names, addresses and tax identification numbers (NIT or CIF, depending on the country).

Invoice Number: Each invoice must be numbered consecutively and uniquely to maintain an orderly control and facilitate its tracking.

Issue Date: This is the day on which the sale is made or the document is generated. It is crucial for tax purposes and to keep an accurate record of inventory.

Description of Products or Services: Each product or service sold is detailed, with its respective quantity, unit price and total.

Taxes: In many countries, the law requires that applicable taxes be included, such as VAT, clearly reflecting the percentage and amount on the invoice.

Total to Pay: This is the sum of all products or services sold, together with the amount of tax if applicable. This is the final amount that the customer must pay.

Payment Terms: Here, it is specified whether the payment is cash, credit, or under another type of agreement, as well as any possible due dates.

Why is a Sales Invoice Important?

For companies, the sales invoice is not just a legal tool to record a transaction, but also an essential document for financial control and tax compliance. Let's see some key reasons:

Accounting Control: Invoices allow for orderly control of sales made and cash flow. They facilitate bank reconciliation and balance closing.

Tax Compliance: They are a documented proof that allows for compliance with tax obligations, such as payment of sales tax.

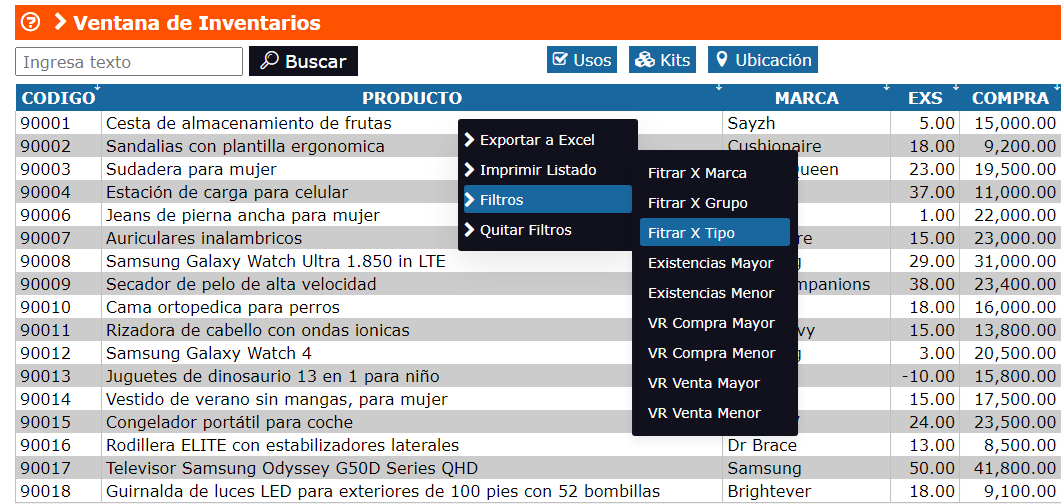

Traceability and Inventory Management: In systems like Inventories1A, each invoice issued is automatically recorded, updating the inventory and facilitating product tracking.

Customer Rights: Upon receiving a sales invoice, the buyer has the right to claim if the products or services do not meet the agreed terms, as the invoice serves as proof of the transaction.

How Does the Inventories1A Software Emit a Sales Invoice?

Inventories1A facilitates the creation and management of sales invoices in a quick and efficient manner. Here are some benefits of using this software to issue invoices:

Automation: With Inventories1A, the invoicing process is automated, generating documents in seconds and updating the inventory in real-time.

Personalization: You can personalize the invoices with your company's data, such as logo, address and payment terms.

Integrated Management: Each sale recorded with an invoice is automatically integrated with other modules of the software, such as Accounts Receivable, Kardex, and Cash, facilitating total business management.

Multi-currency: If your company handles multiple currencies, Inventories1A allows you to issue invoices in the required currency.

Traceability and Reports: The system stores a complete history of issued invoices, allowing for detailed reports to be generated for financial analysis and audits.

A sales invoice is much more than a simple document; it is an essential tool for financial control, inventory management and tax compliance of any company. With Inventories1A, invoicing is faster, more efficient and fully integrated with the rest of the company's operations, allowing for more precise and professional control of your sales.