Tax implications of inventories in companies with cross-border operations

In the era of globalization, companies with cross-border operations face complex tax challenges. One of the most critical aspects is inventory management, as it can have a significant impact on the company's tax burden. In this article, we will explore the tax implications of inventories in companies with cross-border operations and how they can minimize their tax burden.

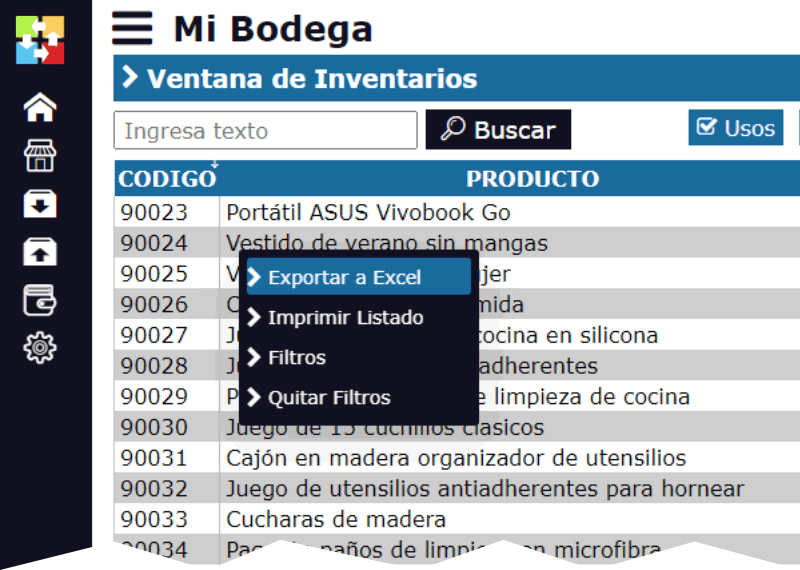

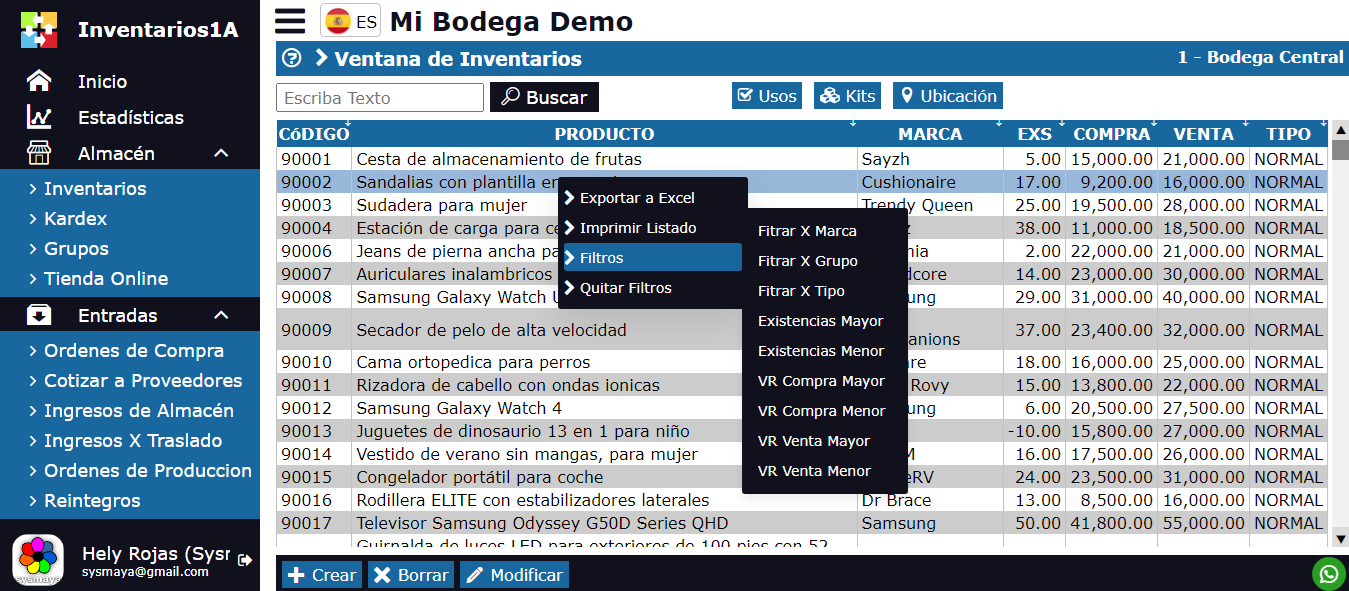

What are Inventories in Companies with Cross-Border Operations?

Inventories in companies with cross-border operations refer to the goods and materials stored in different countries or regions to meet customer demand. These inventories can include finished products, raw materials, components, and other materials necessary for production and distribution of products.

Types of Inventories in Companies with Cross-Border Operations

There are several types of inventories that can be relevant for companies with cross-border operations, including:

- Finished Goods Inventories: refer to products that have been produced and are ready for sale.

- : refer to materials used to produce products.

- Component Inventories: refer to components used to produce products.

- Replacement Parts and Accessories Inventories: refer to replacement parts and accessories used to maintain and repair products.

Tax Implications of Inventories in Companies with Cross-Border Operations

Inventories in companies with cross-border operations can have a significant impact on the company's tax burden. Some of the most important tax implications include:

Property Taxes

Inventories may be subject to property taxes in the country or region where they are stored. These taxes can vary depending on the location and type of inventory.

Transfer Taxes

The transfer of goods between countries or regions may be subject to transfer taxes. These taxes can vary depending on the country or region of origin and destination of the goods.

Income Taxes

Inventories can generate income that is subject to income taxes. These taxes can vary depending on the country or region where the income is generated.

Value-Added Taxes (VAT)

Inventories may be subject to value-added taxes (VAT) in the country or region where they are stored. These taxes can vary depending on the location and type of inventory.

Minimizing the Tax Burden of Inventories in Companies with Cross-Border Operations

To minimize the tax burden of inventories in companies with cross-border operations, it is essential to consider the following strategies:

Tax Planning

Tax planning is fundamental to minimizing the tax burden of inventories. This includes identifying opportunities to reduce taxes and implementing strategies to minimize the tax burden.

Supply Chain Optimization

Supply chain optimization can help minimize the tax burden of inventories. This includes identifying opportunities to reduce costs and implementing strategies to improve the efficiency of the supply chain.

Use of Tax Treaties

Tax treaties can help minimize the tax burden of inventories. This includes identifying opportunities to reduce taxes and implementing strategies to take advantage of the benefits of tax treaties.

Conclusion

Inventories in companies with cross-border operations can have a significant impact on the company's tax burden. It is essential to consider the tax implications of inventories and implement strategies to minimize the tax burden. Tax planning, supply chain optimization, and the use of tax treaties can be effective tools for minimizing the tax burden of inventories in companies with cross-border operations.